Financial, Investment & Stewardship Guidance

Over Two Decades of Financial Experience

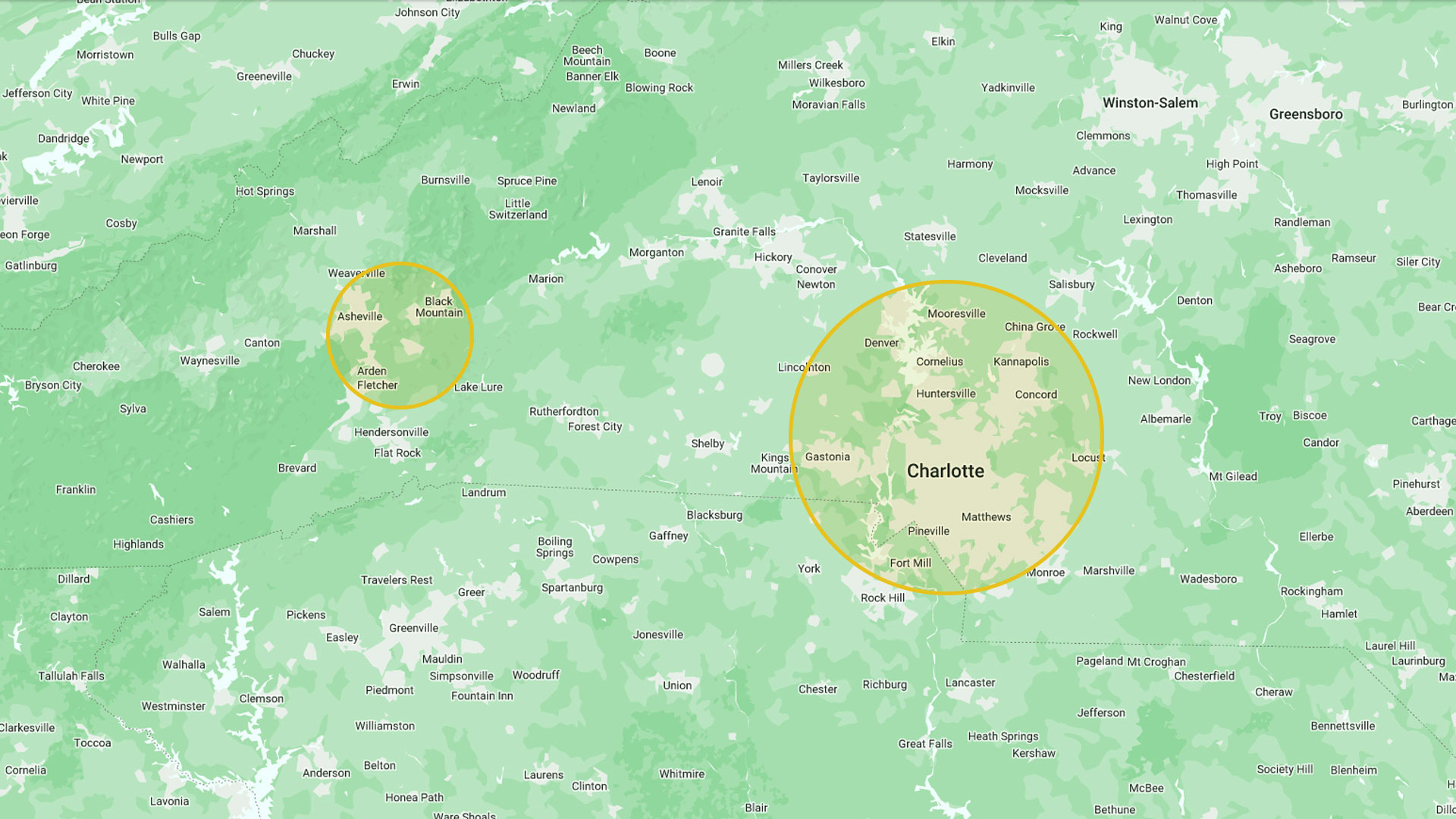

Leading Financial Planning Consultants in the Matthews, NC Area

Welcome to Tassel Capital! Tassel Capital’s professional staff is at your service to support you and your financial and investment questions. Clients commonly ask about portfolio risk, retirement, safe withdrawal rates, college savings, tax reduction, estate planning, best uses of margin, or debt retirement. Tassel Capital also provides virtual or remote services to clients in over eighteen states. Contact their office today and start talking with an experienced financial planner today.

Full Range of Services

Ready to give your financial planner a call? Call us today!

Personalized Assistance From Industry Experts

Get To Know Your Financial Planners

Tassel Capital has provided investment management services to clients since 2002. The Tassel Capital team is comprised of professional trained to assist you in making the best investment decisions focused on your goals. Explore the options available for you and talk with one of the Tassel Capital professionals today!

Financial Planners With Your Goals In Mind

Your Best Interests Are Secured

Tassel Capital acts as a fiduciary for all of its customers as a fee-only Registered Investment Advisor. Tassel Capital’s fiduciary duty compels it always to provide recommendations in the client’s best interests and disclose any conflicts of interest. Tassel Capital has no financial incentive to use specific funds or products in portfolios because it is a fee-only firm. Tassel Capital is solely focused on constructing the optimal portfolio for you and assisting you in achieving your long-term objectives.

Fees

- Tassel Capital does not accept commissions.

- Tassel Capital discloses all costs paid by clients.

- Tassel Capital does not get paid from any other service providers – all income is paid by clients who receive quarterly invoices listing the exact fee paid to Tassel Capital.

If you are in the Matthews, NC area, get a financial planner that is always on your side with your goals as the prime objectives. Call us at (704) 814-6780 today for more information and ask about our free introductory consultation.

Areas we serve include:

- Matthews, NC

- Charlotte, NC

- Mint Hill, NC

- Waxhaw, NC

- Weddington, NC

- Ballantyne, NC

- Piper Glen, NC

- South Park, NC

- Plaza Midwood, NC

- Harrisburg, NC

- Huntersville, NC

- Cornelius , NC

- Davidson, NC

- Mooresville, NC

- Fairview, NC

- Concord, NC

- Mint Hill, NC

- Waxhaw, NC

- Weddington, NC

- Ballantyne, NC

- Piper Glen, NC

- South Park, NC

- Plaza Midwood, NC

- Harrisburg, NC

- Huntersville, NC

- Cornelius , NC

- Davidson, NC

- Mooresville, NC

- Fairview, NC

- Concord, NC

![]()

Tassel Capital also provides virtual/remote service to clients in over 18 states